Everyone is naturally drawn to its country of origin and so are the NRI's. It is often seen that NRI's seek to have a permanent residence option in India irrespective of their plan to move back to their home country or not. Besides, India has been recently making it to the news for being a country surging with economic opportunities and is identified as a potential investment zone. Such opportunity should certainly be availed by all NRI's by purchasing at least one property in India.

Taking this ahead, let us list down few basic reasons why NRI's should invest in India and what makes their home country an irresistible investment destination:-

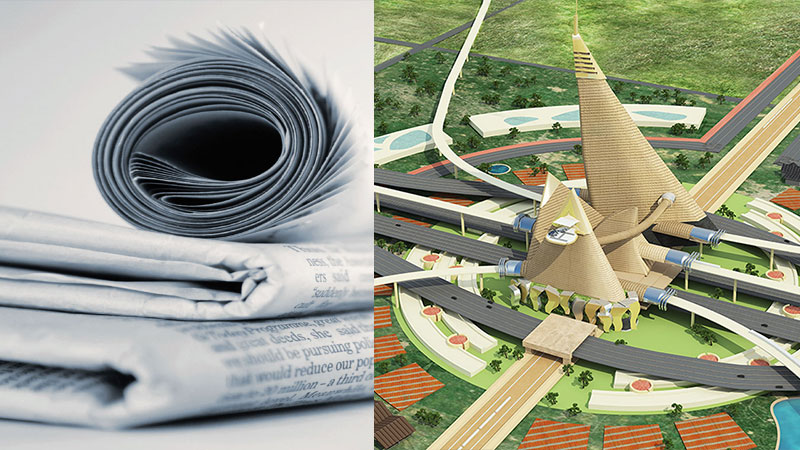

Indian real estate market has seen some dip in prices in the last two years. The properties have thus become cheaper and are expected to witness a 'U' turn from here. Given the rise in economic activities of India, acceleration in commercial and industrial activities and growth in demand for residential housing options, the property valuations are anticipated to pace up going forward. Tier I and Tier 2 cities are in focus due to the 'Housing for all by 2022' mission and AMRUT scheme making them good investment options. NRI's are also advised to invest in Dholera, the first smart city of India to generate exponential returns over a shorter time period.

If you have your basic papers in place, getting funding for a NRI is an easy job. Up to 80% of the property value can be funded through any financial institution at a cheaper rate than that available in any Western country.

The high returns expected on Indian property along with an added advantage of favorable taxation makes investing in India a win-win situation for NRI's. A NRI is advised to hold any property for at least 3 years from the date of purchase so that he may avail the benefits of long term capital gains. By doing so, he shall only be entitled to maximum taxation of 20% on accrued or realized profits. Tax on long term capital gains can be inflation adjusted which in turn reduces the actual tax significantly. Alternatively, the NRI can also utilize the sale proceeds from a three year old property to buy another Indian property to escape from paying any taxes.

If the NRI does not plan to move in to the property purchased in India, he may consider renting it out to someone else. The ideal way shall be to get the property funded through some bank to avail exemption on the interest on home loan amount. Such interest shall be deducted from taxable income. Additionally, he may also enjoy one third tax exemption on rental income on account of repair and maintenance expenses, whether incurred or not.

At the end of a NRI's working tenure, he may consider moving back to his home country. The investment made in property today can serve as a home for the NRI post retirement. Till such time, he may continue to enjoy the low rate of interest and taxation benefit on the property.